It all starts with onboarding...

Fintech founders often say that trust is their #1 KPI – and for good reason.

More than half of users drop out during fintech onboarding on average. The problem is real.

And the fact that in fintech, people have to trust you with their money, not just their time, amplifies your responsibility as the one in charge of the product.

Even minor confusion or doubt can trigger “money-interface anxiety”. Low conversion usually boils down to a “lack of trust” and unclear flows that make users too anxious to continue.

In short, trust precedes traction.

So, how do you design for trust from the ground up? Let’s break it down, from crafting a frictionless onboarding to refining the micro-copy, visuals, and subtle cues that quietly tell users “your money is safe here.”

The Cognitive Cost of Money-Interface Anxiety

Dealing with finances is inherently stressful for most of us.

Unlike a gaming or social app, a fintech product carries high stakes (people’s money, personal data, legal compliance).

The slightest design misstep can plant a seed of doubt: “Is my money safe? What if I mess up this transfer? Who exactly am I giving my information to?” This money-interface anxiety is the enemy of conversion and retention.

A 2022 Signicat report found the average abandonment rate during fintech onboarding is 63%.

These people weren’t quitting because the interest rate was 0.1% lower. No way to know that yet. They left because the process felt confusing or untrustworthy.

What’s more, many early fintech products have had rigid, bank-like processes that treated users like forms to be processed. We’ve all been burned by those horrible bureaucratic designs.

But, enough with the prelude. Let’s cut to the chase. Here’s what to do.

How to Instill Confidence Straight from the Onboarding

Pro tip:

First impressions matter. According to the Nielsen Norman Group’s “Trust Pyramid,” users progress through levels of trust (from basic credibility to willingness to share sensitive data) only if their needs are met at each stage.

In practice, it means you have to broadcast trustworthiness through your signup screen, your landing page, your very first dialog.

To get through those levels of trust, it helps to think in layers.

Layer 1: Invisible Safety (Foundation)

At the base, the product must actually be secure and compliant. But measures like encryption, KYC/AML compliance, etc., should work behind the scenes, not create friction.

Of course, you should use proper authentication and data encryption, but don’t make users jump through hoops unless necessary.

If possible, let users peek at the app or understand the benefit before heavy steps like ID verification or linking a bank. Users are far more willing to complete KYC when they know what they’ll get.

For example, some apps now allow users to explore in a read-only mode or delay full verification until they try to do a transaction.

Layer 2: Guided Flow (Process)

The middle layer is where you start adding UX flow design. Onboarding should have manageable steps.

How?

1 Use progress indicators (“Step 2 of 5”), tooltips, and defaults to lead the way.

2 Provide just-in-time explanations (e.g., if you ask for an ID upload, briefly note “We need this to verify it’s you – takes less than 2 minutes”).

3 A guided flow also adapts to context: for instance, add a “save and resume” option for lengthy verifications so users feel in control.

Layer 3: Reassuring (Surface)

The top layer is what the user directly sees and interacts with – the copy, visuals, and micro-interactions.

They have to reassure and motivate.

Tell them, “Almost there – just a few quick questions”. Show some trust badges or small lock icons with explanations, animations on success, etc.

Ease some fears as well with a phrase like “All information is encrypted and kept private” next to a password field.

Another tip.

Nothing is more anxiety-inducing than pressing “Submit” and seeing nothing happen.

Always acknowledge actions – e.g., a loading spinner or “Submitting…” state – so users know the app is working, not frozen.

If a user makes an error, show a clear error message at that field and explain how to fix it (“Invalid email format, please check for a typo” is much better than a red exclamation with no explanation).

Also, users actually appreciate a well-placed “Are you sure? Check that all looks right” when it comes to their money. It doesn’t sound as condescending as you think in fintech.

Next, Your Micro-Copy

Scrap that jargon. Seriously.

Ever noticed how a tiny hint of text can make you go “Oh, got it”?

In fintech onboarding and KYC flows, microcopy is your secret weapon. Be sure to sprinkle those little instructions, helper texts, or field labels.

First of all, kill the jargon before it kills your conversion.

You probably know what “KYC compliance”, “beneficiary account”, or “AML check” mean. Normal users probably don’t. So, unless your audience is finance experts, replace that jargon with plain-English descriptions.

For example, instead of a button that says “Begin KYC”, say “Verify Your Identity”. Instead of a form title “Beneficiary Details”, try “Who Are You Sending Money To?”

Tone matters, too. Try being empathetic.

For instance, when asking for an ID upload, a line like: “Your ID will only be used to verify your account. We’ll never share it.” can preempt the user’s worries.

Or if you need additional info, say “Just one more thing – we need your XYZ to comply with local regulations. Thanks for bearing with us!”.

Imagine you get a message “Error: documents missing” or Verification failed – user not recognized”. Now, that’s scary.

How about “We couldn’t match your photo. Let’s try again with a clearer picture or better lighting?”

Now, that’s better.

Finally, microcopy can solve some issues that design can’t.

For example, many apps slap a little “?” icon next to fields, but if that icon has no tooltip or text, it’s useless. A hint text will beat a vague icon every time.

Spot the difference:

- An icon of a lock vs. text that says “Your data is encrypted and secure”.

- A calendar icon vs. a note “Format: DD/MM/YYYY”.

- A warning triangle vs. “Passwords must be at least 8 characters”.

When in doubt, spell it out.

Visuals and Subtle Motion Cues

Now, a little bit of cognitive dissonance, since you've just been told that text is so omnipotent.

Add. Visuals.

In fintech apps, visual design and subtle motion cues also play a huge role in communicating trust. More than you think.

Many fintech apps, for example, incorporate a lock icon or shield symbol in places like the login screen or near the account balance. This isn’t just decorative – it’s a shorthand that users intuitively read as “secure”.

Don’t rely on the icon alone, though. Pair it with a reassuring phrase or use it consistently as part of your branding for security-related features.

Also, pay attention to making sure your product has an uncluttered layout with some whitespace. Those tend to feel more professional.

If your UI is too busy or messy, users might subconsciously equate that with the product being unsafe or poorly managed.

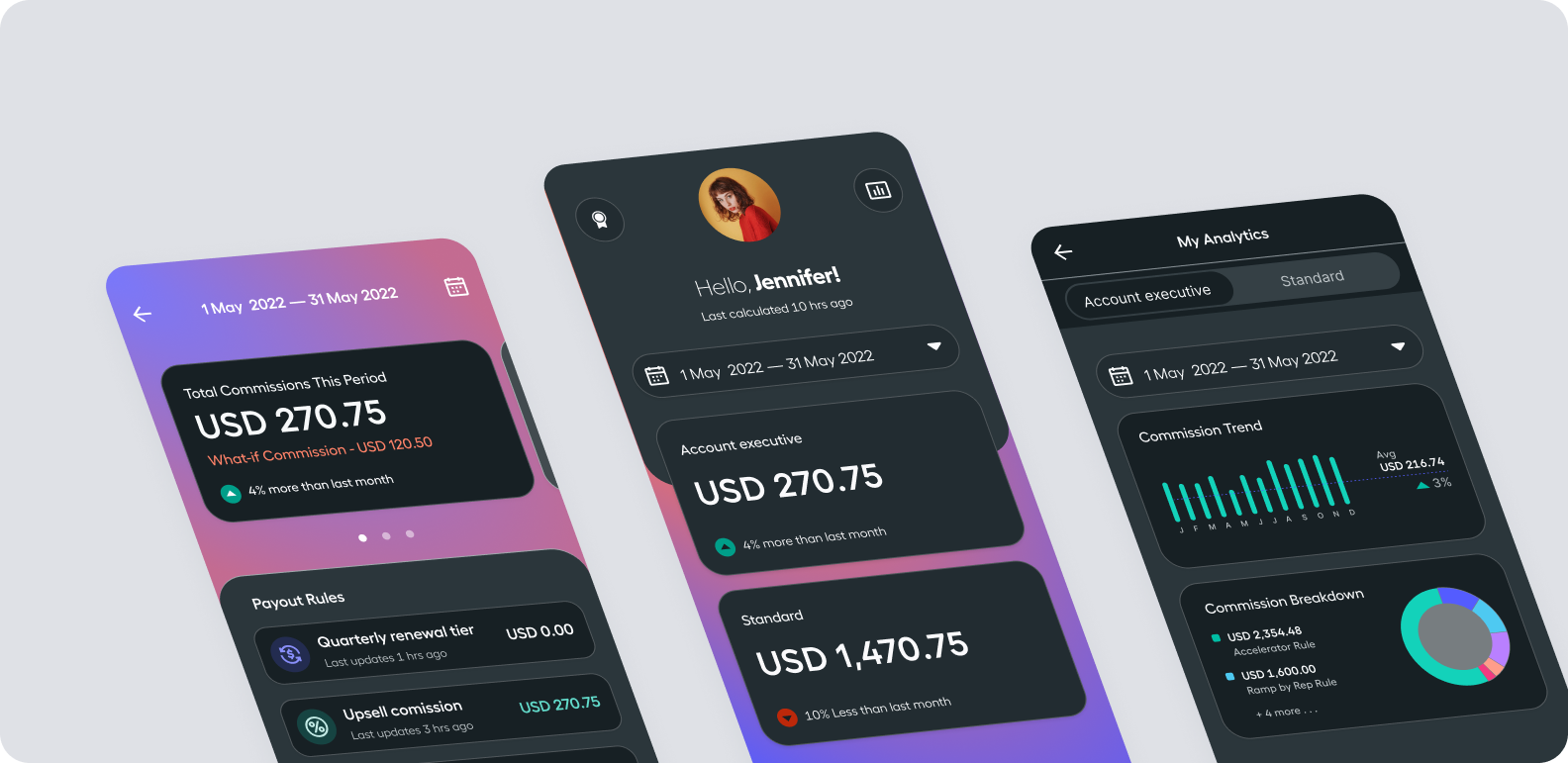

For example, when our design team redesigned the onboarding for BlockEarner (a DeFi fintech app), the goal was to “make users feel financially safe” through design.

Another piece of advice is to add micro-interactions. It’s those tiny animations or responses to user actions. They are fantastic for building trust.

Why? Because they show the system is alive and responsive.

Immediate visual feedback reduces user anxiety in fintech apps. Even something as small as a button that changes color when pressed, or a slight vibration on a successful tap (haptic feedback), contributes to a sense of reliability and completion.

A few best practices for motion cues:

Keep them subtle and give them purpose.

This is not the place for wild, bouncy animations or lengthy loading spinners. The best fintech micro-interactions are often barely noticeable – a 0.2-second fade, a slight slide, a tiny vibration.

Examples:

- Fade-in confirmation message (“Payment Sent!”) with a checkmark that appears for a couple of seconds

- Shake animation on a wrong password entry (to mimic a head shake “no”)

Subtle, though.

Making users wait through a 5-second fancy logo animation each time they log in will not gain you trust.

Guide with motion

When something important changes on screen (especially outside the user’s focal point), a bit of motion draws their attention appropriately.

For example, if their account balance updates after a deposit, you might briefly animate the balance value. Maybe a quick highlight or an upward count animation.

This says, “Look, your balance changed,” and assures them the money went in. Some apps do a subtle cha-ching or a green flash when a deposit succeeds.

Show system status

Fintech involves waiting (for transactions, for approvals, etc.), and waiting is when users get nervous.

That’s when you add live status indicators.

It can be:

- A tiny animated syncing icon

- A progress bar

- A progressive loader (“Uploading document… 45%”)

Use motion to prevent mistakes

This is a clever one. Try adding a tiny bit of friction via motion for dangerous actions – for example, the “swipe to confirm” pattern requires a deliberate gesture to execute a transaction and will prevent accidental taps.

It will also tell your user that you take extra care for important actions.

Another example is a long press to reveal sensitive info. It could be holding down a “Show Balance” button. Seeing your balance or any other sensitive data is intentional, and you should make your design treat it as such.

Finally, after working with designers for three years, I simply cannot forget to remind everyone about maintaining consistency in the visual design of their product.

Fonts, colors, iconography… Them being consistent creates cohesion. Cohesion, in turn, creates trust.

If every screen looks like it belongs to a different app, users may feel the product is unstable or unprofessional.

Founder Checklist

Let’s now do a quick sanity check for either your current product or your next release.

If all 10 questions are answered with a yes, congratulations, your product feels trustworthy. If at least 3-4 got a “no” - you might want to do a quick fix-up using the advice you learned in this article.

- Does your first screen make it immediately clear what your product does and who it’s for?

- Are you using any jargon or technical terms that a normal user might not understand?

- Is your onboarding a smooth step-by-step progression?

- Do you tell users what to expect at each step?

- Is your tone of voice helping or hurting trust?

- Are you providing feedback for all user actions?

- Does your product guide people back on track after errors with helpful messages?

- Have you placed trust signals where they matter?

- Did you optimize for mobile?

- Would I trust my product with my own money, and would I recommend it to a friend right now?

Practical takeaways (TL;DR):

If you do nothing else, do these 3 things tomorrow:

1) Add a progress indicator or at least a “few steps left” note to your onboarding if it’s not there.

2) Rewrite one piece of confusing fintech jargon in your UI into a simpler phrase (e.g., change “Initiate ACH” to “Bank Transfer”).

3) Pick one key action (deposit, signup, etc.) and add a reassuring confirmation animation or message right after the user does it.

1) Add a progress indicator or at least a “few steps left” note to your onboarding if it’s not there.

2) Rewrite one piece of confusing fintech jargon in your UI into a simpler phrase (e.g., change “Initiate ACH” to “Bank Transfer”).

3) Pick one key action (deposit, signup, etc.) and add a reassuring confirmation animation or message right after the user does it.

Start with these little changes, and then gradually keep improving your fintech design.

FAQ

Why is trust critical in fintech design?

Trust in fintech design is essential because it reduces "money-interface anxiety," enabling users to feel secure while handling financial transactions. Given the high stakes of dealing with money and personal data, poor design can lead to user drop-offs, directly impacting conversion and retention rates.

What is "money-interface anxiety"?

"Money-interface anxiety" refers to the apprehension users feel when interacting with fintech platforms due to doubts about security, clarity, or reliability in processes. This anxiety often results in hesitation or abandonment before completing onboarding or financial transactions.

How can fintech companies improve onboarding processes?

Fintech companies can enhance onboarding by ensuring smooth, clear, step-by-step flows using progress indicators and informative tooltips. Allowing users to preview app benefits before finalizing actions, like ID verification, can also reduce friction and establish trust early on.

What role does microcopy play in fintech design?

Microcopy serves as a quiet powerhouse in fintech design, simplifying jargon, clarifying user instructions, and assuring users during key moments. For instance, replacing "Begin KYC" with "Verify Your Identity" creates a more accessible and empathetic user experience.

How do visuals enhance user trust in fintech apps?

Visual elements like consistent layouts, lock icons, and micro-interactions convey professionalism and security. Subtle animations or haptic feedback during actions reassure users that the system is functional and trustworthy while reducing cognitive load.

Why is user feedback important in fintech?

User feedback during interactions, such as a loading spinner or error correction prompts, instills confidence and clarity. Acknowledging user actions demonstrates responsiveness and ensures a more transparent, less anxious experience for customers.

How can motion cues improve fintech UX?

Motion cues like progress indicators, subtle animations, or guided swiping actions enhance fintech UX by showing system responsiveness. These cues reduce user frustration, clarify screen changes, and prevent accidental actions, thus boosting reliability.

What are trust signals, and why do they matter?

Trust signals, such as security badges, encrypted data statements, and compliance icons, reinforce the safety and reliability of fintech platforms. Placed strategically, these signals can alleviate user fears and ensure peace of mind during critical actions.

How can founders audit their fintech product for trustworthiness?

Founders can run a checklist evaluating jargon usage, onboarding smoothness, feedback clarity, and mobile optimization. Asking if they’d trust the product with their own money is a final, honest test of the platform's credibility.

What’s a quick win to enhance fintech UX tomorrow?

Implementing progress indicators during onboarding or rewriting jargon into plain language are impactful steps. Adding confirmatory animations or messages for key actions like deposits further solidifies user trust and product credibility.

About the Author:

Written by Anastasiia Khodan, Content Manager and Writer at Merge Rocks (a design agency with 100 + startup clients, lots in Fintech, Healthtech, SaaS).

Anastasiia translates the day‑to‑day wisdom of the Merge squad into stories that founders can act on the next morning. Her passion is becoming an expert storyteller.

Check out her blog with various design and tech articles here.